Top San Luis Obispo Trust Attorney Klaus Gottlieb Recognized

Originally Published by Cision PRWeb Feb 15, 2024, 16:03 ET Klaus Gottlieb, an Estate Planning Lawyer based in San Luis Obispo, has been honored with two

Originally Published by Cision PRWeb Feb 15, 2024, 16:03 ET Klaus Gottlieb, an Estate Planning Lawyer based in San Luis Obispo, has been honored with two

Introduction to A/B Marital Trusts In estate planning, the strategic use of A/B Marital Trusts has been a cornerstone for couples aiming to optimize their

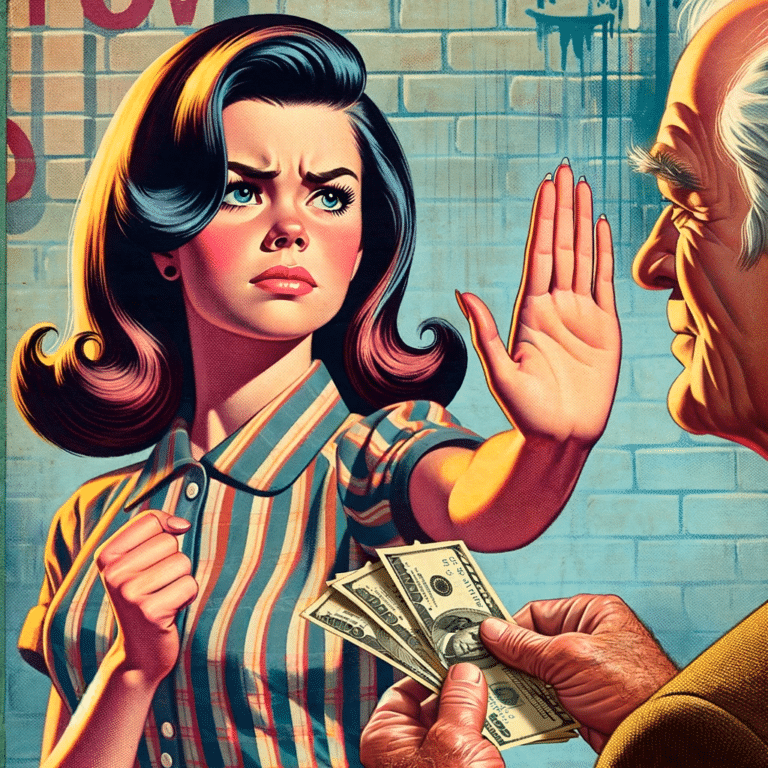

Q: What is an incomplete gift? A: Incomplete gifts are gifts with strings attached. An incomplete gift is a transfer of assets where the person

I recently had the opportunity to give two invited talks, one at Indiana University Medical School and the other one at the Monterey College of

A disclaimer trust and a power of appointment trust are estate planning tools that can be used together to provide flexibility in how assets are

Modern statutes have evolved to regard adopted children as integral members of families, emphasizing the best interests of the child. While the majority of states

We don’t spam! No more than five mailings per year.