Personalized and Trustworthy

Your Estate Planning Success Factors

-

Dedication to the client

Our approach to estate planning stands apart by ensuring personalized, direct engagement from the very first consultation to the finalization of your estate plan. Unlike larger firms where cases may be passed down to less experienced staff, our commitment is to provide you with the undivided attention of our principal attorney throughout the entire process. This ensures that your estate plan not only meets your financial goals but also aligns with your family’s emotional needs, offering a tailored, comprehensive solution designed specifically for you

-

Fee Transparency

Our commitment to fee transparency ensures that we clearly outline the costs associated with your estate planning needs from the outset. We conduct a thorough assessment of your requirements to provide a comprehensive fee structure, whether as a flat rate for a complete estate planning service or an hourly rate for specific tasks like research. This approach guarantees clarity and predictability, allowing you to make informed decisions without any surprises.

-

Recognized Legal Scholarship

Since starting his practice, Dr. Gottlieb (Klaus to his clients) has published more than 100 blog posts that examine basic and complex issues in estate planning. In addition, he has written articles for Trusts & Estates Quarterly of the California Lawyers Association, and the San Luis Obispo County Bar Association Bar Bulletin. He teaches Wills & Trusts at the Monterey College of Law and has been elected as a Super Lawyer, an honor awarded to only the top 5% of attorneys in the field.

-

Master's in Taxation and Estate Planning

Klaus Gottlieb is currently studying for a dual LLM in Taxation and Estate Planning on a merit scholarship, a distinction that is quite rare in the field. This pursuit not only highlights his dedication to gaining a deep understanding of these complex areas but also signifies the advanced, tax-efficient solutions he can provide to his clients. The LLM, or Master of Laws, is an advanced legal qualification that emphasizes a specialized area of law, underscoring a commitment to excellence in professional practice here in San Luis Obispo county and beyond.

Play Video

Innovating Wealth Management

The Future of Wealth Care

Attached below is an article Dr. Gottlieb wrote for the Bar Bulletin of the San Luis Obispo Bar Association with the original title “Forces that shape estate planning over the next 20 years – and a call to action.”

Summary

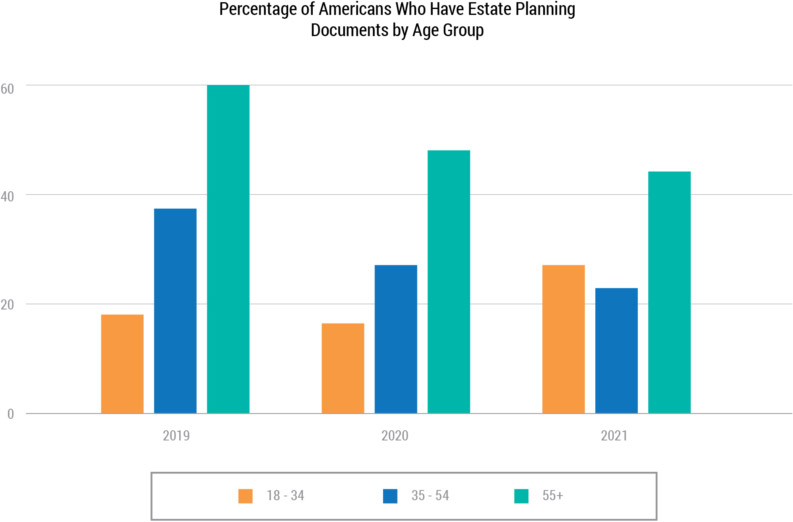

Millennials (72 percent) and members of Generation X (59 percent) are significantly more pessimistic about achieving financial security in retirement, compared to Baby Boomers (43 percent) and the Silent Generation (26 percent). Still, Millennials have a reason for optimism. The unprecedented wealth transfer from the Boomers to the successor generations could alleviate some or most of their anxiety.

However, Boomers may not be able to transfer as much wealth as they may want to because, as they age, they must pay for their long-term direct care needs and medical care. These costs will certainly continue to rise, especially as the shortage of long-term care workers increases.

Tax rates are currently unsustainably low, and it is quite certain that government expenditures will need to be lowered and taxes raised.

Tax increases will likely take a bite out of the amount of wealth that goes to family members and, unfortunately, instead of being distributed more broadly by the government for social services, taxes will be increasingly used to service the federal debt. Much wealth will therefore not be put to its most productive use, i.e., buying homes, starting businesses, or giving to charity, as the Wall Street Journal optimistically predicts, but instead be swallowed up by health care, long-term care, and taxes to fund the government debt service.

Recent Google Reviews

Client Testimonials

Sheila Lebbad

a month ago via Google

Easy and straight forward consultation.

Totally professional and completely attentive.

Clearly verbalized presentation and all areas warmly discussed.

We are happy and satisfied with our finished Trust Documents.

Klaus...Read More

Scotty McManus

8 months ago via Google

Klaus, thank you for assisting my client with her estate planning process. It was assuring to work with you and see how you asked...Read More

jill Renfro

a year ago via Google

Klaus Gottlieb, MD, JD was easy to work with, professional, and responded to my questions in a timely manner. The entire intake process was easy...Read More

Dylan Philyaw

a year ago via Google

Schedule a free consultation with Klaus Gottlieb

Become Familiar with Wealth Care Lawyer

Frequently Asked Questions

First, the term is memorable because it makes people pause: “I have heard healthcare lawyer – but never wealth care lawyer”. Indeed, the term “Wealth Care Lawyer” is unique and US Patent Office trademark protection is pending. Second, wealth care describes an approach that is more holistic than ‘estate planning’. See item 2.

The term ‘wealth care’ is usually heard in the financial planning context. Part of successful lifetime financial planning is legal succession planning, typically summarized as “Trusts and Estates”, but a Wealth Care Lawyer does more: He or she works with your other advisors, such as financial planners and tax professionals, to create the plans and documents that make it possible for your family, loved ones or charitable organizations to remember you as a prudent and caring individual who exerts a positive influence even after death.

Dr. Gottlieb does business as “Wealth Care Lawyer” and this designation is protected. Yes, currently he is the only one who can use this service name. He plans to build his practice slowly, one success at a time. However, as business grows and to maintain even service levels, he plans to take on other associate lawyers. After incorporation these individuals will also become “Wealth Care Lawyers”.

It takes more than a sharp pencil, knowledge of the law, and a laptop to practice wealth care. Leo Tolstoy famously said that “Happy families are all alike; every unhappy family is unhappy in its own way”. That view is too static. Dr. Gottlieb has decades of experience as a physician in observing and counseling grieving families and knows that seemingly happy families can turn into unhappy families quite easily over any number of disputes, especially when inheritance matters are unsettled. Having done his best as a physician he felt frustrated that he could be of no more use. This and other life experiences motivated him to take up law later in life. While in law school his professors assumed that he would veer towards medical malpractice, but no: “In my mind, medical malpractice is too much of accusing the innocent or defending the incompetent.”

In his own family and circle of friends he has seen instances where skillful and empathetic estate attorneys made all the difference, especially when planning was conducted well in advance. Attorneys with less empathy, e.g., less ability to consider complex family dynamics, made things worse. What is best for tax planning for an individual may be an odious solution for the rest of the family. There are no areas of the practice of law where more emotions are unleashed that regularly lead to irrational and damaging behavior. The Wealth Care Lawyer must be technically and emotionally competent.

A medical background is also of use in navigating potential medico-legal minefields such as questions of competency to make a will, create a trust or enter into other complex transactions. Dr. Gottlieb has the requisite background to examine the issues from both a medical and a legal perspective thus potentially avoiding challenges to the validity of the mentioned transactions.

Dr. Gottlieb earned his MBA at Indiana University, a top ranked school, and was inducted into Beta Gamma Sigma, the international business honor society for the top 10 % students. He passed the CFA (Chartered Financial Analyst) level 1 exam, which is notoriously difficult, on the first attempt.

Wealth Care is more than trust and estates, it is a comprehensive approach that may require the services of several professionals. However, their work needs to be coordinated and evaluated. A lawyer without a background in finance and business will not feel comfortable in finding the most suitable advisors, evaluating their recommendations in context, or acting as your coordinator. At a minimum Dr. Gottlieb will work with your current advisors. But, if you wish, the respective professionals can directly be engaged by Dr. Gottlieb which usually extends the protection of the attorney-client privilege to these persons and their direct associates.

Yes. Dr. Gottlieb speaks and reads German fluently and he is familiar with German civil and inheritance law. According to 2019 data, 72,255 current California residents (0.7 %) were born in Germany. Many of them are in the age groups that may expect an inheritance from German relatives or be themselves interested in bequeathing property to persons in Germany. This can lead to much confusion because German inheritance law (‘Erbrecht’) is very different. Dr. Gottlieb can help evaluate the situation and determine whether local (German) legal assistance is needed, and if so, who to select.

Dr. Gottlieb attended Northwestern California University School of Law while he was working full-time as a pharmaceutical industry executive. He earned straight A’s in Wills, Trusts, and Community Property. He passed the California Bar exam, considered one of the most difficult in the nation, on the first attempt (pass rate 53 %). He is an active member of the San Luis Obispo County Bar Association where he has contributed articles to the Bar Bulletin about Trust and Estate topics and the Trusts and Estates Section of the California Lawyers Association.

The first contact will be a 15-minute complimentary phone or video consultation which can be arranged by making an appointment on the scheduling page. Should the potential client wish to retain Dr. Gottlieb, the next contact will usually be a meeting in the client’s home which typically requires 2 hours or more. If clients prefer the consultation can also be conducted at the law office address. Furthermore, all contacts can be remote, but, at a minimum, video conferencing will be necessary for the most important interactions. Subsequent or less critical correspondence can be by email or phone call.

In principle, the entire State of California. However, if frequent face-to-face interactions are required, this may not be practical. In this case, the service area encompasses San Luis Obispo, Monterey, Kern and Santa Barbara counties.

Fees are flat fees, not hourly, unless specifically agreed upon. The fees are in line with what practitioners usually charge. Please see the Fees and Services page.