As an estate planning attorney in San Luis Obispo County, my focus on the region’s economic outlook extends beyond mere interest—it’s integral to delivering top-notch advice and services. Understanding local economic trends is crucial for anticipating shifts in estate planning needs, growth in the client population, and the community’s charitable giving patterns.

Growth of Client Population: Economic prosperity in San Luis Obispo County not only attracts new residents but also increases the complexity of their estate planning needs. A flourishing economy means more individuals and families will require sophisticated strategies to manage wealth transfer and minimize tax liabilities.

Propensity for Charitable Giving: A thriving local economy often correlates with heightened charitable activities among residents. Being informed about economic conditions enables me to advise clients on tax-efficient charitable giving, ensuring their contributions make a meaningful impact.

Tailored Estate Planning: Knowledge of the economic landscape allows for personalized estate planning advice, tailored to the evolving needs of our community. Whether it’s addressing the nuances of a booming real estate market or planning for the succession of a family-owned business, understanding our economic environment is key.

The Big Picture

County residents have a median age of 41.1 years compared to CA as a whole with 37.9 years. However, this number is skewed downwards because of the large student population (Cal Poly). Indeed, the proportion of residents above the age of 65 is 22.2% compared to California as a whole (15.8%). In the County, 16.9% of the population was under 18 years of age, compared to 21.8% for California. See population pyramid.

Interestingly, about twice as many residents in the County claim Italian heritage (6.3%) than California as a whole (3.4%) (historical background). English, German, and Irish each take between 11.2% and 13.3%. English is the predominant language at home, only 17.8% of households have a preference for another language, as opposed to 44.4 % for California as a whole. 9.9% of SLO County residents are foreign-born, compared to 26.7% for California.

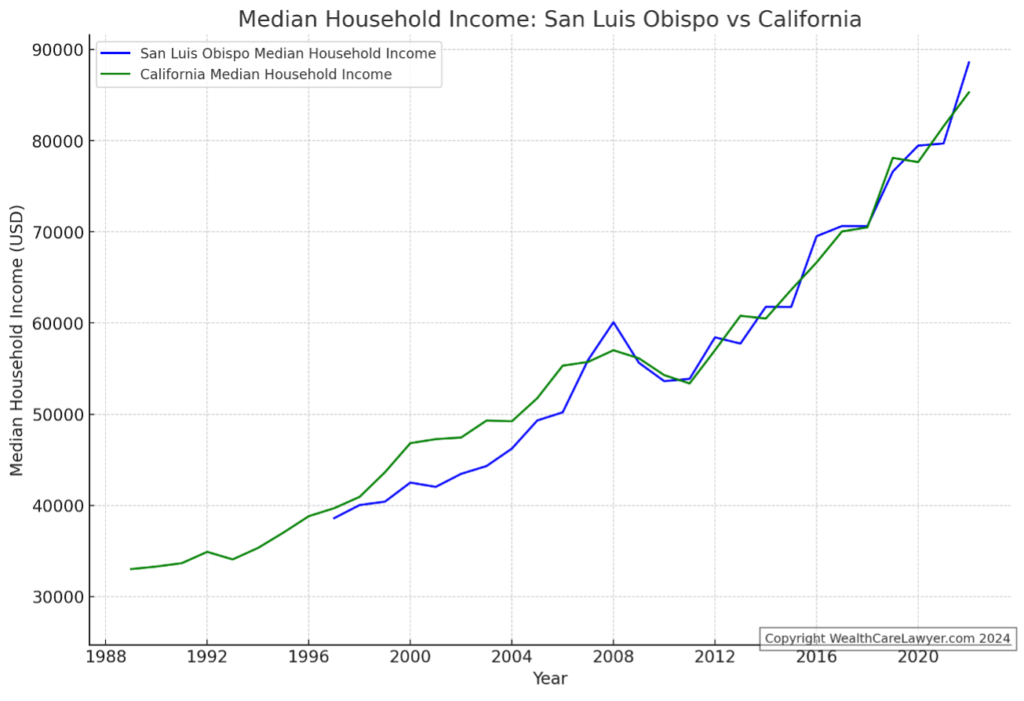

The median household income in San Luis Obispo County and California in 2022 was about the same, $90,216 and $91,551, respectively. Poverty rates were no different at 12.2%.

More people in SLO County had a bachelor’s degree or higher than in California, 41.2% vs 37.0%. It is not clear whether new bachelor’s degree of Cal Poly students (counted in the resident population) were included or not. The employment rate was slightly lower for SLO County (56.8%) compared to California (60%). “Agriculture, forestry, fishing and hunting, and mining” was overrepresented in the County at 4.1% (California 2.0%).

The homeownership rate in the County was higher at 61.3% vs. 55.8% for California. The distribution of housing value is shown in a bar graph below. Somewhat incongruously, the percentage of renters was also higher (officially: “moved 2021 or later into occupied housing unit”) in the County at 19.9% compared to California at 16.7%. This could perhaps again be explained, at least in part, by the large resident student population.

Resident Population in San Luis Obispo County, CA

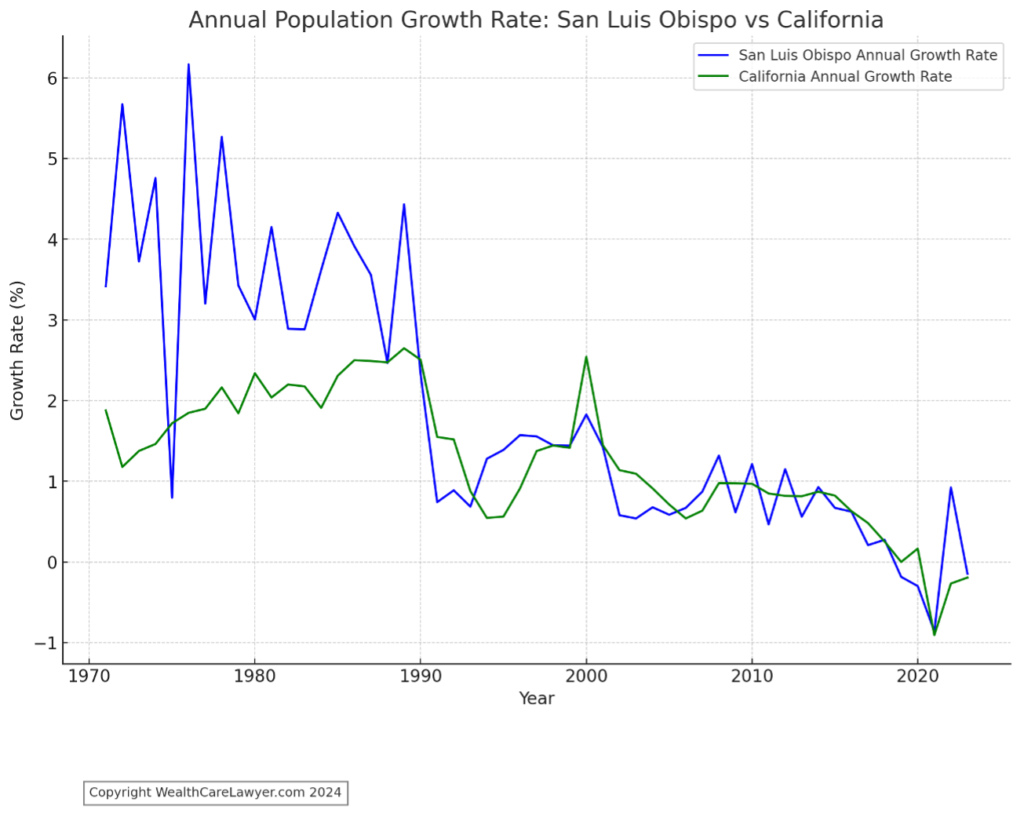

While the overall population of SLO County has seen a steady increase – perhaps leveling off more recently -, much of the excess growth (measured in percent increase) of SLO County compared to California occurred between 1970 – 1990. The most recent spike may or may not be related to an influx of remote workers during the Covid pandemic.

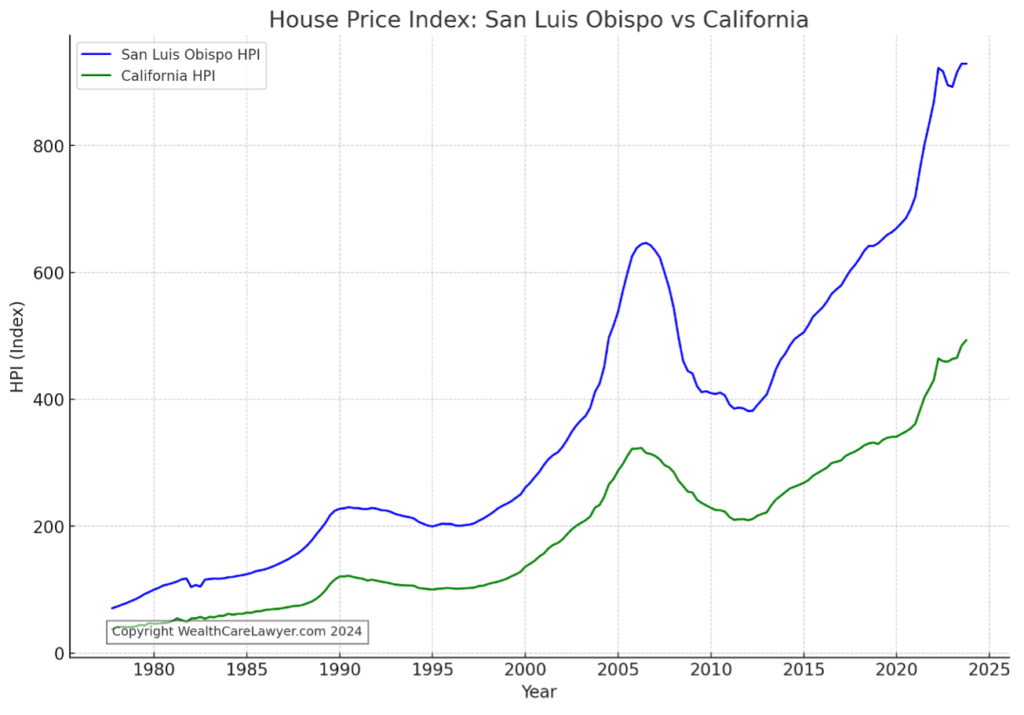

All-Transactions House Price Index for San Luis Obispo-Paso Robles, CA

As can be seen, housing is considerably more expensive in SLO County than elsewhere in California. The trends largely parallel each other, but peaks are more prominent for SLO County and the distance between the house price indices appears to be widening.

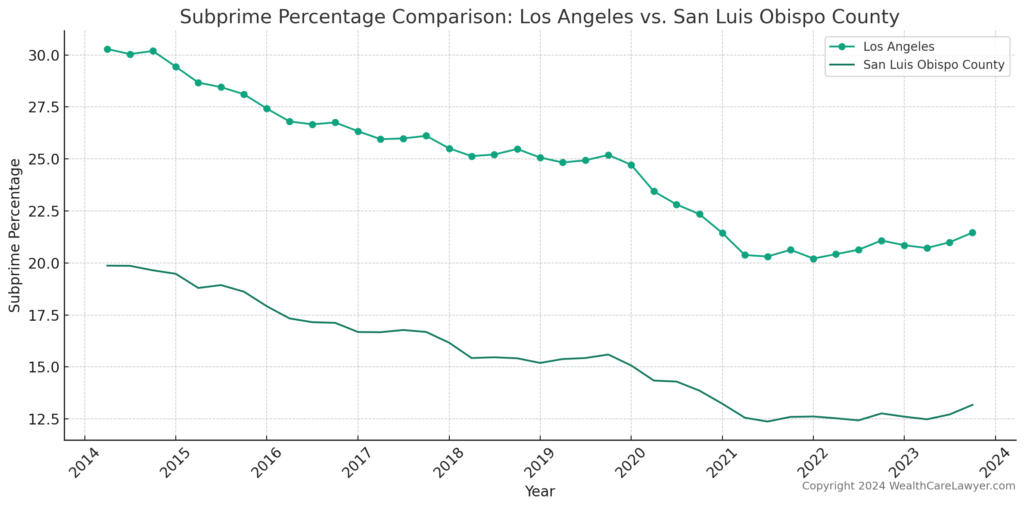

Equifax Subprime Credit Population for San Luis Obispo County, CA

The Equifax Subprime Credit Population has decreased in all counties, albeit from a higher level in large urban areas, as seen here for Los Angeles.

Estimate of Median Household Income for San Luis Obispo County, CA

The constant dollar income median household income figures for SLO County and California are similar, except for a few years between 1997 – 2007. However, considering the much higher home price indices for San Luis Obispo County compared to California as a whole indicates considerable wealth accumulation for residents of SLO County.

Income Inequality in San Luis Obispo County Increasing

| San Luis Obispo and Neighboring Counties | Highest Income Inequality | Lowest Income Inequality |

| San Luis Obispo County, CA – 16.17 | San Francisco County/City, CA – 28.08 | San Benito County, CA – 10.02 |

| Kern County, CA – 15.55 | Marin County, CA – 21.25 | Mono County, CA – 10.15 |

| Kings County, CA – 11.25 | Yolo County, CA – 21.13 | Modoc County, CA – 10.22 |

| Monterey County, CA – 13.37 | Alpine County, CA – 20.98 | Kings County, CA – 11.25 |

| Santa Barbara County, CA – 17.56 | Los Angeles County, CA – 19.52 | Lassen County, CA – 11.32 |

This data represents the ratio of the mean income for the highest quintile (top 20 percent) of earners divided by the mean income of the lowest quintile (bottom 20 percent) of earners in a particular county. San Luis Obispo County has a ratio of 16.17, suggesting that the wealthiest 20% earn, on average, over 16 times more than the poorest 20%. This indicates a significant income disparity, though it is not the highest among the compared counties. Based on the graph it appears that income inequality post Covid has spiked.

Number of Private Establishments for All Industries in San Luis Obispo County, CA

As long as the percent change above the line exceeds the dips below the line we have continued growth. Over the last 10 years, the rate has been positive without dips, a very positive sign, indeed.

Summary and Conclusion

This analysis provides a comprehensive overview of the economic and demographic landscape of San Luis Obispo County, CA, offering valuable insights for estate planning strategies within the region. Key findings underscore the county’s distinctive economic conditions compared to the broader state of California, emphasizing its unique implications for estate planning.

Demographic Trends: San Luis Obispo County exhibits a diverse demographic profile with a median age slightly higher than the California average, partly due to its substantial student population and a significant proportion of residents over 65 years. The county’s heritage and linguistic makeup also differ from statewide patterns, presenting a community with a strong representation of European ancestries and a lower prevalence of non-English speaking households.

Economic Indicators: The economic indicators reveal that San Luis Obispo County aligns closely with California regarding median household income and poverty rates. However, the county distinguishes itself through higher educational attainment and homeownership rates, alongside a distinctive employment sector composition favoring agriculture and related industries. Despite these strengths, the county is not immune to challenges, as evidenced by a housing market that is significantly more expensive than the rest of California and growing income inequality.

Housing and Inequality: The housing market dynamics underscore a critical concern for estate planning, with housing prices in San Luis Obispo County considerably outpacing those in the rest of the state. This trend, combined with increasing income inequality, highlights the need for tailored estate planning solutions that address wealth accumulation and distribution challenges unique to the county’s residents.

Economic Growth and Charitable Giving: The analysis further identifies a stable economic growth trajectory for the county, with implications for the growth of the client population and their estate planning needs. Additionally, the county’s economic prosperity correlates with a propensity for charitable giving, necessitating informed advice on tax-efficient strategies to maximize the impact of such contributions.

At Wealth Care Lawyer, we understand the importance of seeing the whole picture. Beyond just your immediate family circumstances, we consider both macroeconomic trends and local economic shifts, as well as staying abreast of changes in tax law. Our comprehensive approach ensures your estate planning is robust, tailored, and forward-thinking.